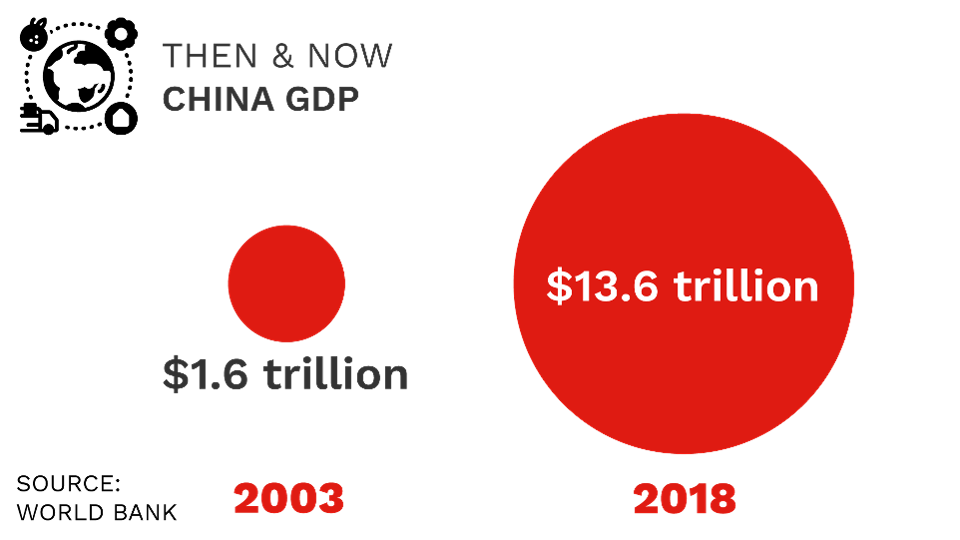

The coronavirus is likely to have a bigger economic impact than previous outbreaks thanks to a rapidly growing Chinese economy and its deeper commercial ties to the U.S. In 2003, when the SARS virus hit, China’s GDP was $1.6 trillion. Today, China’s GDP sits around $13 trillion.

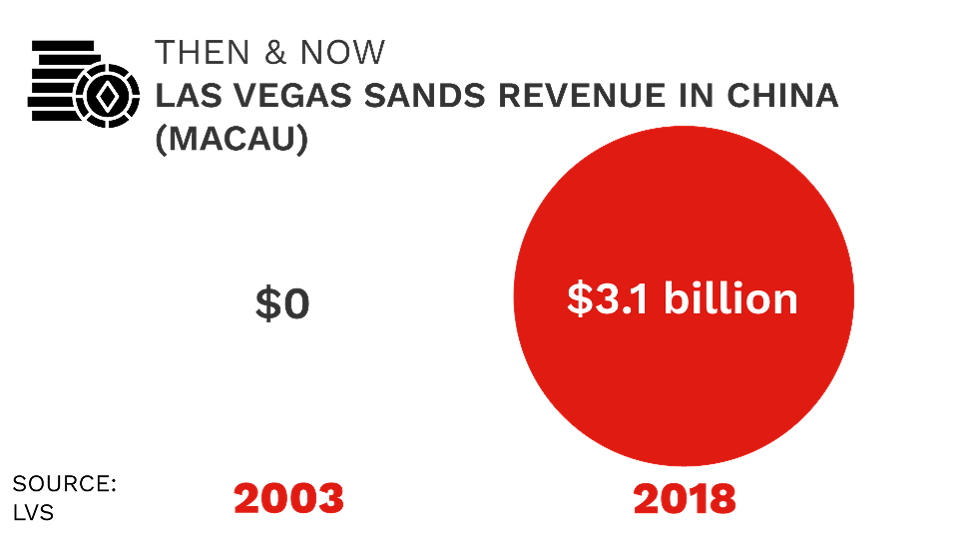

Over that period, China has been a growth hub for U.S. companies looking for ways to boost their bottom lines. Now those companies are on the front lines of a growing health pandemic that’s infected nearly 10,000 people and killed at least 213. Some U.S businesses, like gaming giant Las Vegas Sands Corp. (which is seeing an 80% drop in visitors at its Macau locations amid the outbreak), had no operations when SARS hit in 2003. Earlier this week, the billionaire chairman of Las Vegas Sands, Sheldon Adelson, noted that all employees in the region are wearing masks, and visitors are being screened for an increased temperature, which could indicate possible infection.

How much it will cost the casino giant will be clearer in the second quarter.

“I think it would be foolhardy to think we can reduce costs enough to offset a continuing 80% decline. That’s a real problem for any operator,” president and COO of Las Vegas Sands, Rob Goldstein, told analysts.

China’s economy is among the fastest -growing in the world. There are worries China’s growth could take a big hit amid the coronavirus threat.

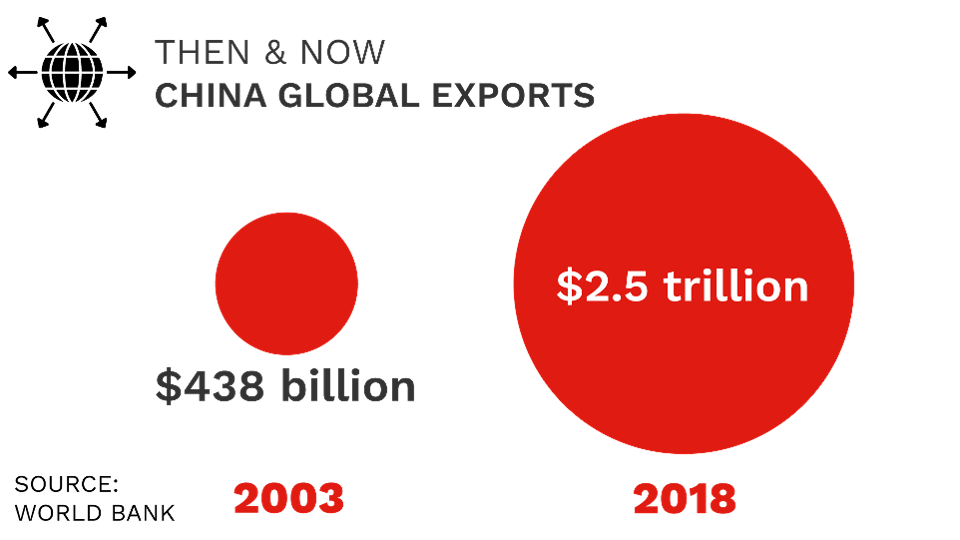

China is exporting more goods than ever before. In 2018, China was the United States’ largest supplier of goods, including electrical machinery ($152 billion), machinery ($117 billion), furniture and bedding ($35 billion), toys and sports equipment ($27 billion) and plastics ($19 billion).

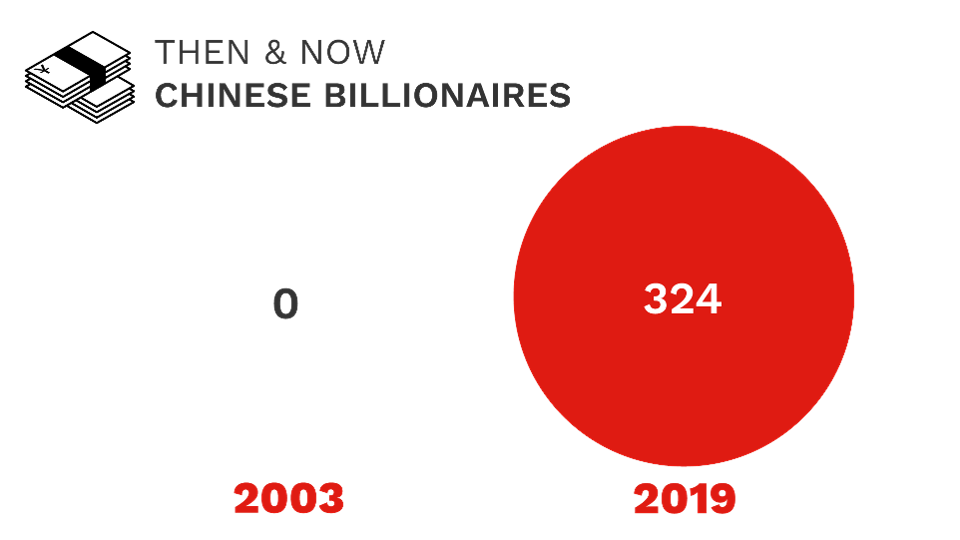

The number of Chinese billionaires is growing. Jack Ma, who recently resigned as chairman of Alibaba, the e-commerce giant he cofounded, is the nation’s richest with a net worth of $42 billion.

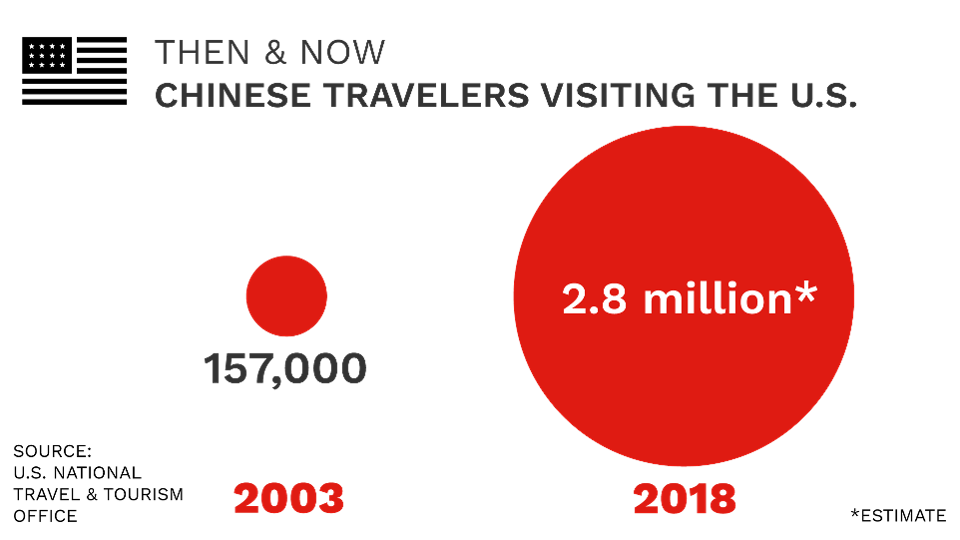

Travel has become a key indicator of quality of life for China’s rising affluent population with more and more Chinese traveling overseas for their vacations, according to Nielsen. Chinese tourists spent an average of $762 per person on shopping on their most recent overseas trip, while non-Chinese tourists averaged $486, according to a 2017 Nielsen survey.

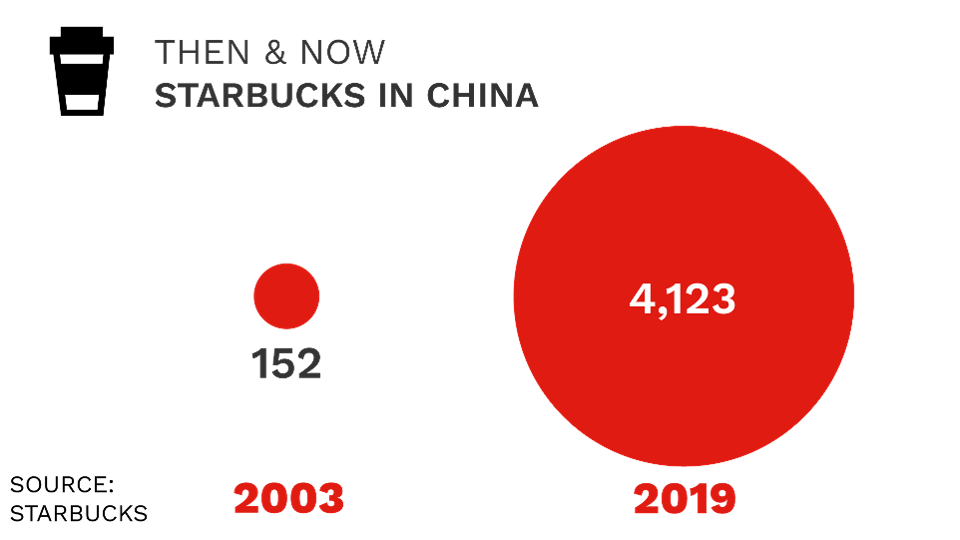

Starbucks announced it’s closed more than half of its 4,100 stores in mainland China amid coronavirus fears. It’s not the only retailer closing stores: H&M closed at least 45 locations and suspended business travel to and from China for its employees. IKEA shut half of its 30 stores in mainland China. Coca-Cola plants have also been affected.

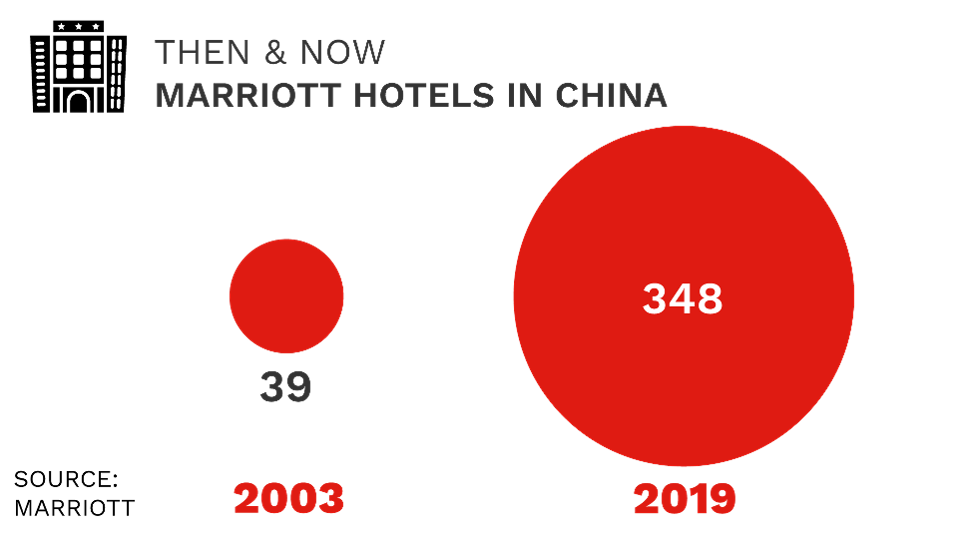

China is Marriott’s biggest market outside of the U.S. In 2018, the company partnered with Alibaba. The agreement allows Chinese travelers to book Marriott hotels through Alibaba’s travel website.

Earlier this week Marriott said it was waiving cancellation fees for hotel stays through February 29, 2020, for guests with reservations at hotels in mainland China, Hong Kong, Macau and Taiwan. The waiver is also available for guests from mainland China, Hong Kong SAR, Macau and Taiwan traveling outbound to other Marriott destinations globally.